Advisory

Collecting art has been a passion of wealthy individuals and families for centuries but there are many different levels at which you can enter the art market. Interesting collections can be curated on lesser budgets with emerging artists or with less familiar names but from an investment perspective this can be higher risk.More »

We monitor the market continuously and can provide you with the latest reports by specialist arts economists. If you are looking to borrow against internationally marketable artworks of high value or use art as collateral to create liquidity in order to add to your collection or for other investment purposes, we can put you in touch with the best financial advisors with whom we collaborate.

What affects value?

Here are some things to consider when collecting art:

PROFILE OF THE ARTIST such as exhibition history or representation in public collections.

RARITY will increase value, a known deceased artist with a small output is likely to be desirable.

AUTHENTICITY It goes without saying that authenticity is of paramount importance but in addition some artists require specialist authentication by a designated expert who holds an established catalogue raisonne (official record of the artist’s output).

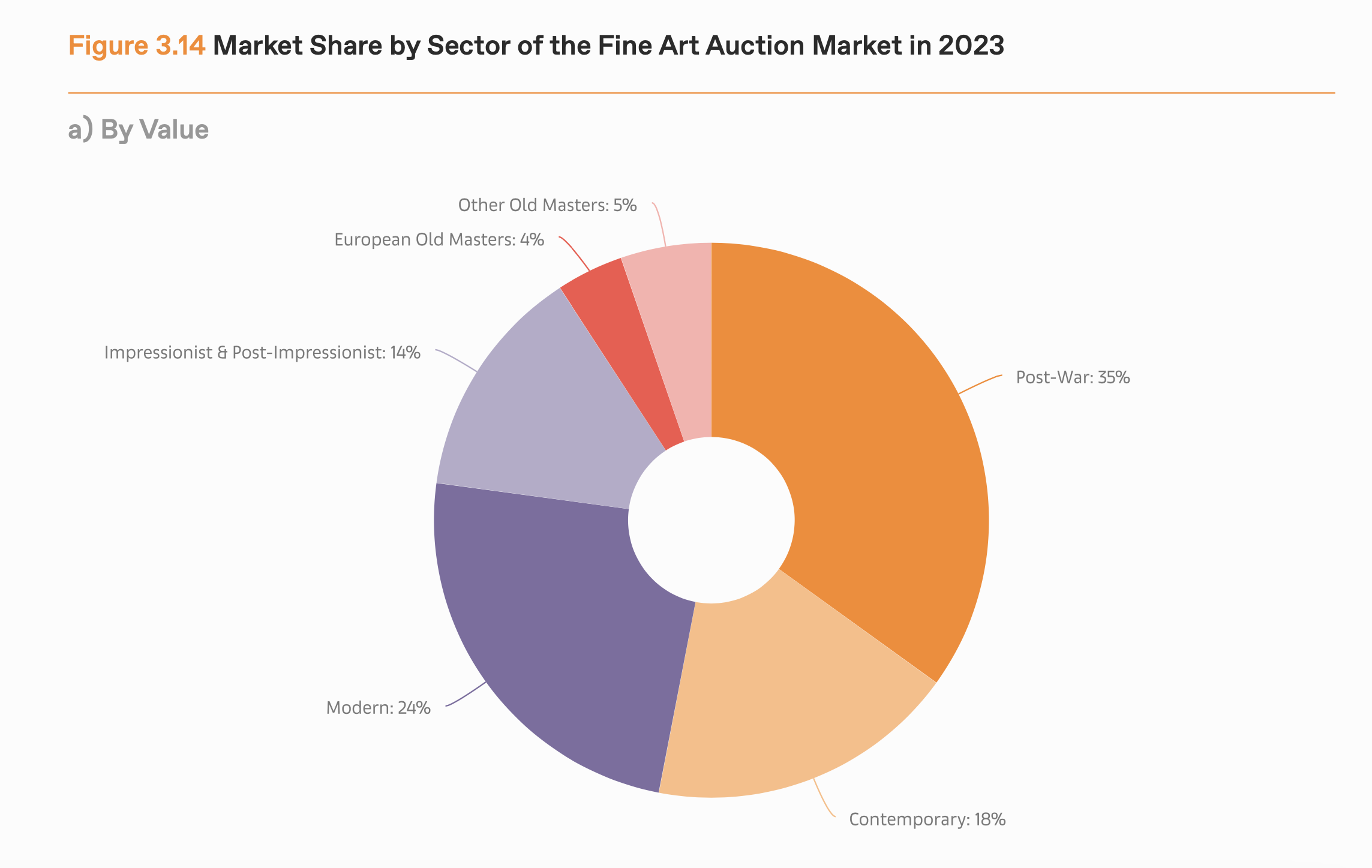

FASHION is a big factor and it is often hard to predict where it will go next. Post War and Contemporary is currently the most popular collecting sector but there are also more focussed trends within it for example artwork by young black female artists is currently desirable.More »

Golden Rules

Buy from reputable gallery or use an art consultant.

If buying at auction look carefully at the catalogue description and know the terminology “after Warhol”, “school of Warhol” “follower of Warhol”. Read the T&C’s and remember to account for buyers’ premium 25% on top of the hammer price.

If buying contemporary, take a look at the artist’s biography, exhibition history and if the artist is in any public collections or has an international standing.

If buying older pieces, review the artist’s track record studying past prices on secondary market. Make sure you are comparing like for like in terms of size, medium, condition and provenance.

So what to buy?

Firstly, buy what you love and feel passionately about.

It helps to identify a period or genre and to read up about that particular area because the market is so broad. Then you might decide to collect one artist or artists from a particular artistic movement or a particular geographical area.

Once you have decided upon your area, take some time to observe and research the market. Consider our check list before settling on a particular painting.

Art is an emotional and subjective subject and unless investment is your primary focus it is likely to be an emotional decision but you can still make sure it is an informed emotional response.

SPOTLIGHT: COLLECTING PRINTS,EDITIONS AND MULTIPLES

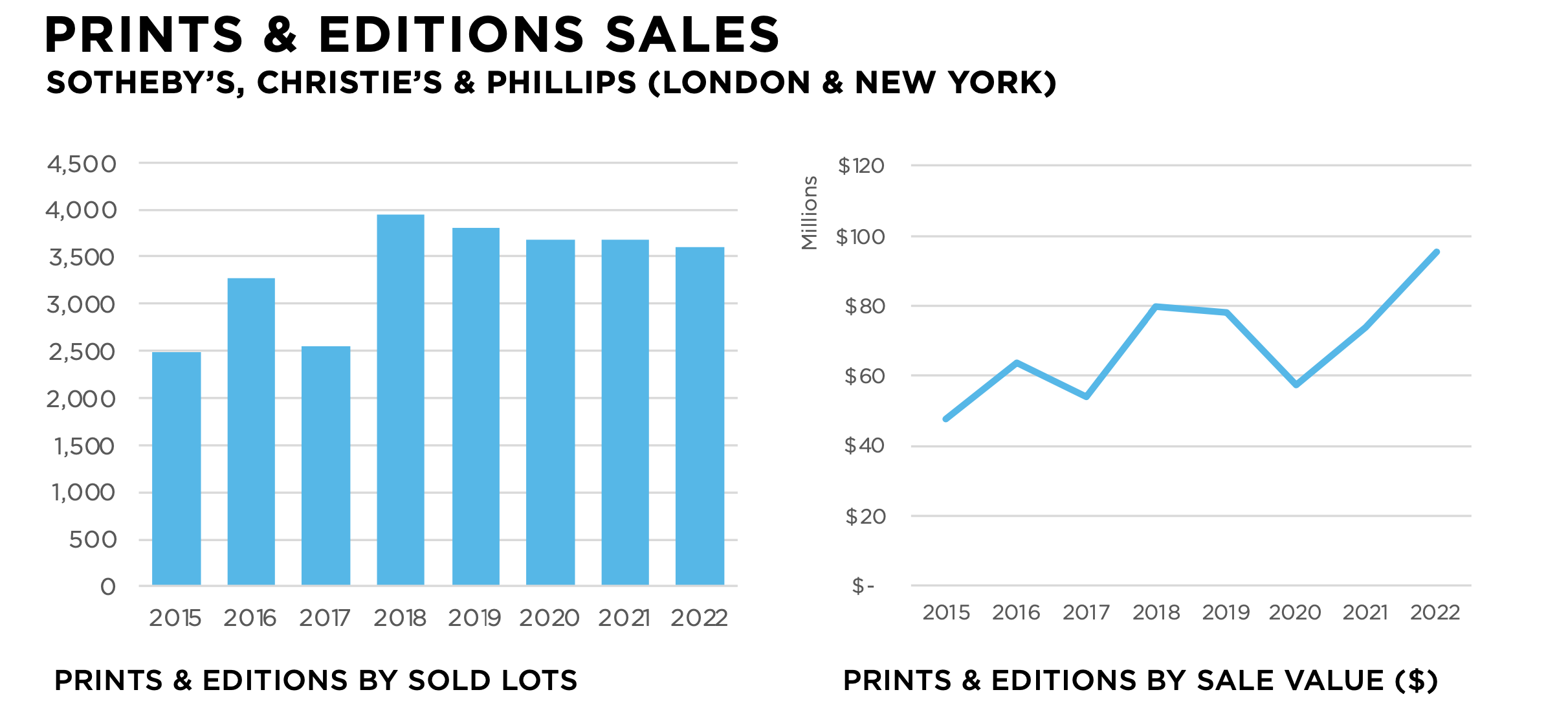

Collecting prints is an often overlooked segment of the art market that has historically played second fiddle to paintings and sculpture. However, over the past 10 years, the market for prints, editions, and multiples has seen a notable increase. This growth can be attributed, in part, to the popularity of artists like KAWS and Kusama, who have incorporated these types of replicated works as a major part of their practice. Additionally, a surge of young collectors, whose tastes and budgets align with these media, has also driven this expansion.More »

Even though auction sales of Post-War and Contemporary prints slowed down after a record-breaking 2022, the number of lots sold in 2023 reached new highs driving the print market past the $500 million threshold for the second consecutive year.More »

In a nutshell, 6 reasons to invest in prints...

1) Prints offer an attractive entry level as they are more affordable relative to unique works by the same artist.

2) They’re proving an investment area for young collectors with Christie’s attributing their 65% increase in Gen Z buyers (2023) to prints and collectibles.More »

Market Trends

*Data from 2023 published in 2024 art market report

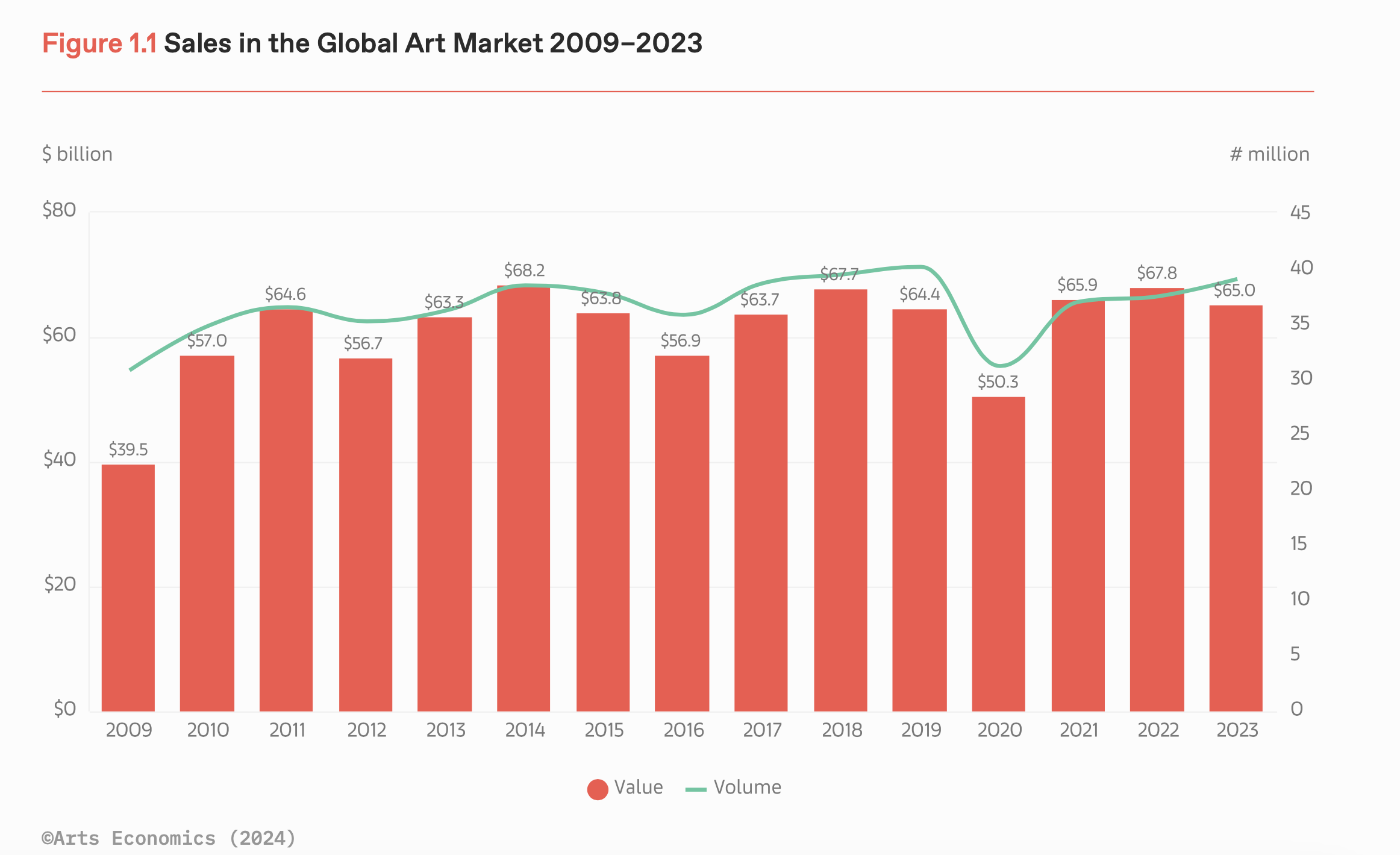

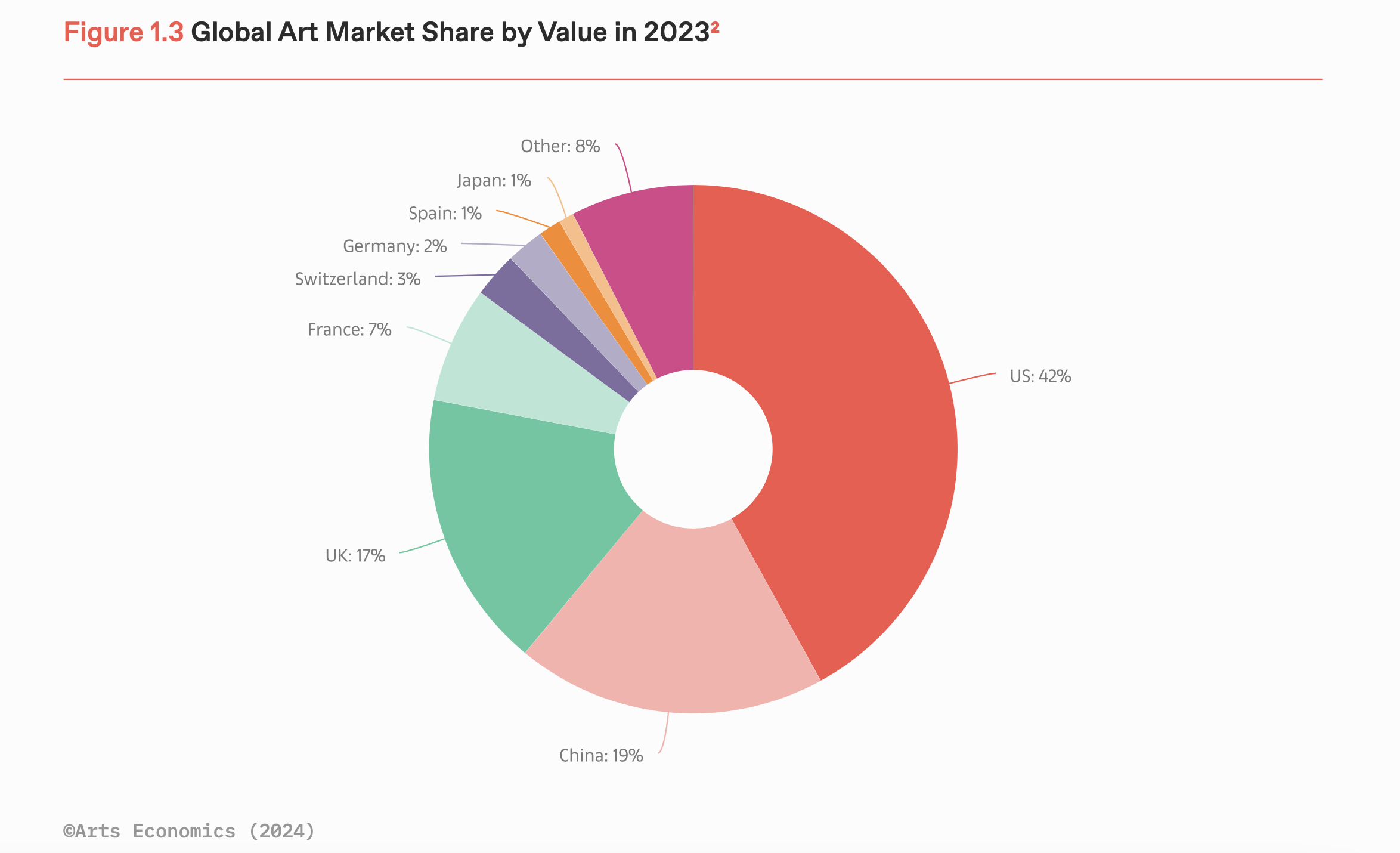

The market contracted last year after two consecutive years of growth, falling by 4% to an estimated $65 billion. The decline spanned both dealer and auction sectors, as dealers and buyers adjusted to evolving market conditions. Although down year-on-year, the market nevertheless remained above its pre-pandemic level of $64.4 billion.

In sharp contrast to recent trends, the high end of the market, which has been driving sales since 2020, contracted in 2023 whereas the volume of sales increased albeit at the lower level with the smaller galleries (turnovers of less than $500,000) expanding by 11%.More »

Collectors continue to favour the Post-War and Contemporary sector in 2023 with a share of 53% which represents 54% for the market by value, followed by Modern (22%) and Impressionist and Post Impressionist (18%).

The highest selling artist at auction in this wider sector was Gerhard Richter, with sales of $252 million, with Jean- Michel Basquiat in second place and Andy Warhol in third place. Two female artists Yajoi Kusama and Joan Mitchell were also in the top five. More »

Outlook for the Market

As 2024 unfolds, the broad trends observed in 2023 are likely to continue. Middle-income consumers find themselves in a relatively comfortable position, both in the United States and across the Atlantic. Inflation is decelerating faster than wage growth, giving consumers spending power from income (rather than needing to rely on creditor savings).More »